<노스크립트>

RoosterMoney*는 재정적으로 어린이를 '교육하고 동기를 부여하고 권한을 부여'한다는 사명으로 2016년에 시작되었습니다. RoosterMoney는 자녀와 부모가 같은 계정에서 용돈을 관리할 수 있는 용돈 앱입니다.

RoosterMoney는 3세에서 17세 사이의 모든 연령대의 어린이를 위한 다양한 도구를 제공하므로 어린이는 어릴 때부터 돈에 대해 배울 수 있습니다. 이 기사에서는 작동 방식, 비용, GoHenry 및 Osper와 같은 다른 용돈 앱과 비교하는 방법을 설명하는 용돈 앱 RoosterMoney를 검토합니다.

RoosterMoney*는 자녀에게 돈에 대해 가르치고 재정적 독립성을 유지하면서 재정을 통제할 수 있게 해주는 용돈 앱입니다.

계정 설정은 간단합니다. 이름과 이메일 주소를 제공하고 비밀번호를 생성하기만 하면 됩니다. 자녀가 귀하를 어떻게 지칭하는지 물어볼 것입니다. 엄마 또는 아빠 - 앱에서 사용하려는 국가 및 통화. 그런 다음 RoosterMoney의 어떤 측면에 가장 관심이 있는지 묻습니다. 별자리표 또는 수탉 카드 - 그러나 가입하기 위해 이것을 선택할 필요는 없습니다.

가입하고 나면 앱에서 어떤 기능이 마음에 들지 않는지 확인하고 원하는 경우 나중에 프리미엄 계정으로 업그레이드할 수 있습니다.

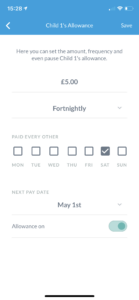

계정을 만든 후 앱에 자녀를 추가하라는 메시지가 표시됩니다. 자녀의 이름, 생년월일 및 성별을 제공해야 합니다. 또한 자녀의 용돈 수당을 입력하고 자녀가 이를 매주, 격주 또는 매월 받을지 여부를 입력할 수 있습니다.

처음에 귀하가 생성한 모든 자녀는 RoosterMoney 앱의 무료 버전인 Virtual Money Tracker 계정으로 자동 설정됩니다. Rooster PLUS 또는 Rooster Card 계정으로 업그레이드할 수 있는 옵션이 있습니다. RoosterMoney에서 사용할 수 있는 다양한 계정에 대한 자세한 내용을 보려면 여기를 클릭하십시오.

(이미지를 확대하려면 클릭)

RoosterMoney에는 자녀의 돈을 추적할 수 있는 세 가지 계정이 있습니다. 아래 비교표에 요약해 놓았습니다.

| 가상 추적기 | 수탉 플러스 | 수탉 카드 | |

| 연령 범위(년) | 3+ | 5+ | 6-18 |

| 연간 비용 | 무료 | 14.99파운드(1개월 무료) | £24.99(1개월 무료) |

| 별표 | | | |

| 가상으로 금액 추적 | | | |

| 일정 수당 | | | |

| 머니팟 | | | |

| 어린이 로그인 | | | |

| 집안일 추적기 | | | |

| 이자율 설정자 | | | |

| 무제한 보호자 | | | |

| 정기 지급 설정 | | | |

| Real money deposits | | | |

| Prepaid debit card | | | |

| Flexible parental controls | | | |

| Debit account details | | | |

*Currently only available in the UK

The RoosterMoney Virtual Money Tracker account is the free version of the RoosterMoney app. It is suitable for children from 3 years old and allows you to virtually track your child's pocket money. This means that no physical money is loaded onto the app, but if you give your child a regular allowance, you can keep track of how much you give them within the app.

If the child spends, saves or gifts some of their allowance, this can also be updated in the app so both you and the child can track how much pocket money has been spent or saved. You also get access to a virtual reward chart, but to use this, you'll need to set the child's currency to stars. You can then set goals for your child to work towards and reward them in stars for good behaviour to help them to achieve their goal.

<시간 />The RoosterMoney PLUS account has all of the features of a RoosterMoney Virtual Money Tracker account, as well as the additional feature of a chore tracker. It is suitable for children from the age of 5 years old and allows you to set tasks for your child to complete.

As your child completes each task, they can get rewarded by earning their pocket money allowance. You can set two types of chores:allowance chores and extra earners. An allowance chore has to be completed for the child to receive their allowance, and an extra earner chore allows the child to earn additional pocket money on top of their allowance amount. To encourage saving habits, you can also set an interest rate within the app. This is a notional interest rate that is funded by the parent and can be selected within the app under the 'Save' pot settings.

Rooster Plus also allows you to set up a recurring payment within the app for things you would like your children to contribute to, such as pet food or maybe a TV and film subscription. The regular payment amount will be deducted from the child's pocket money allowance amount on the day you have chosen for the allowance to be delivered.

<시간 />The RoosterMoney Rooster Card is a prepaid contactless Visa debit card that allows your child to spend and manage their own money whilst allowing you to oversee the account via the app. A Rooster Card allows parents to set daily, weekly, and monthly spending limits, as well as ATM and single transaction limits.

The debit card can also be used abroad for free, as long as transactions are kept below £50. Any transactions over the £50 limit will be charged a 3% fee. As well as getting a Rooster Card, you can also benefit from the same features included with the Rooster PLUS and the Virtual Money Tracker account.

You can choose between three RoosterMoney accounts - the free account or the two different subscription accounts. In the below table, we summarise the subscription fees and any fees associated with a RoosterCard. You can scroll down for further detail on the account limits.

| Fees | |

| Virtual Tracker | FREE |

| Rooster Plus | £1.99 per month/£14.99 per year (first month free) |

| Rooster Card | £24.99 per year (first month free)* |

| Spending online | FREE (limits apply) |

| ATM fees | FREE (limits apply) |

| Foreign transactions | FREE (limits apply) |

| Debit card loads | FREE (limits apply) |

| CHAPS transfer | £10 |

| Bank transfer OUT | FREE (limits apply) |

| Rooster Card replacement fee | £5 (1 free replacement per household) |

*Additional cards cost £19.99 each year

N.B. Rooster Cards can only be loaded by a personal account (business and Paypal accounts are not accepted).

RoosterMoney is authorised and regulated by the Financial Conduct Authority (FCA). The money held in a RoosterMoney account with a Rooster Card is ring-fenced in an account with the high street bank NatWest. The money you deposit, however, is not covered by the Financial Services Compensation Scheme FSCS should RoosterMoney go bust. However, according to its website, RoosterMoney says 'If RoosterMoney went bust, our creditors would not be able to access any of your money due to it being safeguarded. The Financial Conduct Authority would simply distribute all of the funds back to our users.'

예. Rooster Cards can be used abroad for chip and pin and contactless transactions. You can spend a maximum of £50 abroad for free and after this, there is a 3% charge. It is also worth considering that some foreign ATMs will charge foreign transaction fees in addition to a fee for using the ATM itself.

RoosterMoney is rated as 'Excellent' on review site Trustpilot with a score of 4.8 out of 5 stars from over 700 reviews. 88% of customers rate the app as 'Excellent', citing the app as easy to set up and navigate. Parents also comment that the app provides great motivation for their children to complete chores and better understand money. Only 2% of customers rate the app as 'Bad', citing problems with accessing the money debited on the account and technical problems with some transactions.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

RoosterMoney is just one of a range of pocket money apps available. In the below comparison table, we compare RoosterMoney to other pocket money apps from the likes of GoHenry and Osper, as well as junior bank accounts from Starling and Revolut. For more information on the pocket money apps and some of the free alternatives, read our article "The best pocket money apps".

| RoosterMoney* | Nimbl | Osper | GoHenry* | Starling Kite | Revolut Junior | |

| Eligibility (years) | 6-18 | 6-18 | 8-18 | 6-18 | 6-16 | 7-17 |

| Cost | £24.99/year (1 month free) | £28.00/year (1 month free) | £2.50/month (first 30 days free) | £2.99/month (30-day free trial) | £2/month | Free (limits apply to a free account) |

| Loading fee | Free (limit applies) | Free | 50p instant loads or free by debit card | One free load each month and 50p thereafter | Free | Free |

| ATM fees* | Free | Free | Free | Free | Free | Free |

| Fees abroad | 3% transaction fee over £50 per month | £1.50 cash withdrawals, 2.95% transaction fee | £2 cash withdrawal, 3% fee | Up to £50 per month then 3% fee | Free | Up to £250 per month |

| Instant notifications | | | | | | |

| Set spending limits |  |  |  |  | | |

| Chore tracker | | | | | | |

| Child app | | | | |  | |

| FSCS protection | | | | | | |

*Limits apply

Overall, RoosterMoney* is a great app if you are looking to teach your children about money. The free version of the account allows access to the Star Chart and Virtual Money Tracker, but the chart can easily be replicated by a simple handmade rewards chart on the fridge at home.

In addition, it may be easy to forget to update the Rooster Money Virtual Tracker allowances manually when your child spends their pocket money. Accessing the chore tracker, however, is a great way to incentivise your child to earn their pocket money and having separate logins for children allows them to track their progress on their own smart devices, further encouraging independence - though it does come at an additional cost.

The Rooster Card account offers the most benefits for a child to manage their pocket money and is a great way to allow your child to have financial independence whilst still having access to their money and control over their spending habits.

RoosterMoney is marginally cheaper than other similar pocket money accounts, but there are restrictions on how much you can spend. To find out more about the different options available for your child and their pocket money, read our articles:

링크 옆에 *가 있으면 제휴 링크임을 의미합니다. Money to Masses 링크를 통해 이동하면 Money to Masses를 무료로 사용하는 데 도움이 되는 약간의 수수료를 받을 수 있습니다. 그러나 분명히 알 수 있듯이 이것은 제품에 대한 독립적이고 균형 잡힌 리뷰에 영향을 미치지 않았습니다. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - RoosterMoney.