세계 최고의 배당주는 유행을 타지 않았지만 오늘날의 투자 환경에서 특히 매력적으로 보입니다.

결국, 금리가 깊이를 파고들고 있고, 변동성의 망령이 과열된 시장에 드리워져 있으며, 많은 기업들이 지급을 중단하거나 삭감해야 했습니다.

그것이 배당금 귀족과 같은 신뢰할 수 있는 배당 성장주가 들어오는 곳입니다. 수십 년 동안 매년 배당금을 인상해 온 회사는 투자자들에게 현재 위기 동안 배당금이 계속해서 올 것이라는 위안을 줄 수 있습니다. 보잘것없는 채권 수익률은 관대한 배당금을 지급하는 사람들이 소득을 얻을 수 있는 몇 안 되는 곳 중 하나로 만듭니다.

그리고 최고 배당금 주식은 격동의 시장에서 포트폴리오에 안정을 제공할 수 있다는 것을 잊지 마십시오.

펀드 제공업체인 ProShares는 "일반적으로 이러한 고품질 기업은 견고한 비즈니스 모델, 안정적인 수익, 견고한 펀더멘털, 강력한 이익 및 성장 이력을 보여주었습니다"라고 말합니다. "결과적으로 지속적인 배당 성장을 보이는 기업을 특징으로 하는 전략은 광범위한 시장 조건에서 강력한 성과 특성을 보여 왔습니다."

국내 및 해외 배당금은 꾸준히 증가하는 지급액에 대한 오랜 실적을 보유하고 있으며 장기간에 걸쳐 우수한 수익을 창출하는 경향이 있으며 투자자들이 시장의 격동의 시기에 대처하는 데 도움이 될 수 있습니다.

이것은 세계 최고의 배당주를 살펴봅니다. 배당 귀족이라고 불리는 이들은 최소 5년 연속(캐나다 기업), 10년(유럽 기반 기업) 또는 25년(미국 기업) 동안 현금 지급액을 인상했습니다. 이러한 주식은 안정적이고 증가하는 수입원을 제공하며 ... 밤에 잠을 더 잘 잘 수 있도록 도와주는 안정감을 줍니다.

로퍼 테크놀로지스 (ROP, $391.93)은 의료 및 과학 영상, RF 기술 및 소프트웨어, 에너지 시스템 및 제어 등을 생산하는 산업 회사입니다.

또한 2018년 이 최고의 배당주 목록에 합류한 가장 어린 배당 귀족 중 한 명입니다.

다각화된 산업 회사는 2017년 말에 25년 연속 현금 분배를 인상한 후 배당금 귀족을 위해 선택되었습니다. 그런 다음 2018년 11월에 배당금을 분기별 주당 46.25센트로 12% 인상했습니다. 그런 다음 지난 11월 분기 배당금은 51.25센트로 10.8% 더 뛰었습니다.

인수, 유기적 성장 및 더 강력한 마진의 조합은 Roper가 이익을 늘리지 않고 배당금을 착즙하는 데 도움이 되었습니다. 더 좋은 점은 S&P 500의 배당금이 약 55%에 불과한 13%에 불과한 낮은 배당률입니다. 이는 ROP의 배당금이 안전할 뿐만 아니라 앞으로 몇 년 동안 계속 상승할 준비가 되어 있음을 의미합니다.

영국 기반 Halma (HLMAF, $29.14) 건강, 안전 및 환경을 다루는 기술 사업에 투자합니다. 회사의 Infrastructure Safety에는 화재 감지 및 진압 및 보안 모니터링 제품이 있습니다. 공정 안전 부문에는 위험한 가스 누출을 감지하고 공기 품질을 모니터링하기 위한 도구가 있습니다. 환경 분석은 수질 평가 및 개선에 중점을 둡니다. 그리고 의료 사업은 눈 건강과 혈압을 분석하는 기기를 가지고 있습니다. 매출의 대부분은 미국과 유럽에서 발생합니다.

Halma는 틈새 시장 인수와 신제품 및 서비스에 의한 유기적 성장을 결합하여 16년 연속 매출 및 이익 증가를 달성했습니다. 2019 회계연도에 수익은 13% 증가했습니다. 그 중 약 10% 포인트가 유기적이었지만 Halma는 인프라 안전 및 건강 관리 시장의 틈새 시장 인수에서도 이익을 얻었습니다.

이 꾸준한 Eddie는 40년 동안 중단 없는 배당금 성장을 하여 유럽 배당금 귀족 내 최고의 배당주 중 하나가 되었습니다. Halma는 또한 2019년 회계연도 보고서에서 2019년 3월 현재 자사 주식에 대한 투자가 지난 10년 동안 1,141%의 수익을 올렸을 것이라고 자랑했습니다. 이는 나스닥 종합 지수의 두 배 이상입니다.

HLMAF는 5월 2일에 지급된 중간 배당금을 7% 인상하여 41년 연속 배당금 성장을 달성했습니다.

프랑코-네바다 (FNV, $143.00) 광산을 소유하지 않는다는 점에서 대부분의 광산 회사와 다릅니다. 대신 미래 수익의 일부에 대한 대가로 다른 회사의 광산 개발 자금을 조달합니다. 말 그대로 왕족 플레이다. 광산 회사가 프로젝트에 대한 전통적인 자금 조달을 받는 것이 어려울수록 Franco-Nevada에 더 좋은 기회가 주어집니다.

FNV는 최근 몇 년 동안 석유 및 가스 수익원으로 다각화되었습니다. 석유 및 가스는 현재 수익의 16%를 차지합니다. 전반적으로 Franco-Nevada는 미주 지역에서 수익의 80%를 창출하고 나머지 지역에서는 20%만 창출합니다. 따라서 북미 및 남미 이외 지역에서 지리적 확장 기회가 있습니다.

Franco-Nevada는 현재 생산 중인 56개의 금 및 56개의 에너지 작업, 생산에 임박한 또 다른 35개의 금 프로젝트, 개발 탐사 단계에 있는 229개의 금 및 에너지 작업에 자금을 제공하고 있습니다.

회사는 지난 5월 분기 배당금을 주당 26센트로 인상했습니다.

S&P 글로벌 (SPGI, $351.81)(이전에 McGraw Hill Financial로 알려짐)은 S&P Global Ratings, S&P Global Market Intelligence 및 S&P Global Platts 뒤에 있는 회사입니다. 대부분의 투자자들은 벤치마크 S&P 500 지수를 유지하는 S&P Dow Jones Indices의 대다수 지분을 알고 있을 것이지만 기업 및 재무 분석, 정보 및 연구 분야에서도 핵심적인 역할을 하고 있습니다.

S&P Global은 1937년부터 매년 배당금을 지급해 왔으며 S&P 500 기업 중 최소 47년 동안 매년 배당금을 인상한 25개 미만의 기업 중 하나입니다. 가장 최근인 1월에 SPGI는 분기 배당금을 주당 67센트로 17.5% 인상했습니다.

폐기물 연결 (WCN, $98.40)은 미국 42개 주와 캐나다 6개 주의 700만 명 이상의 고객에게 2차 시장을 위한 쓰레기 및 재활용 수거 서비스를 제공하는 폐기물 서비스 회사입니다. 또한 태평양 북서부에서 화물 및 고형 폐기물 컨테이너의 철도 이동을 위한 복합 운송 서비스를 제공합니다.

2019년 WCN은 배당금에 1억 8100만 달러, 자사주 매입에 1억 2940만 달러를 지출하면서 6억 8120만 달러의 잉여 현금 흐름을 창출했습니다. 회사는 코로나바이러스 발생에 직면하여 자본 지출을 줄이고 비용을 통제하고 있습니다.

웨이스트 커넥션은 지난 10월 배당금을 16% 인상하여 주당 18.5센트로 인상했습니다.

덴마크의 Coloplast (CLPBY, $16.09)는 장루 및 요실금 제품의 세계적인 선두업체입니다. 예쁜 시장은 아니지만 전체 의료 시장보다 빠르게 성장하고 있습니다. 이 회사는 또한 상처 치료 및 중재적 비뇨기과 분야에서 상위 5위 안에 있습니다.

Coloplast는 유럽에서 60%, 기타 선진국에서 23%, 신흥 시장에서 17%의 매출을 창출합니다.

중재적 비뇨기과 사업은 Titan 브랜드의 음경 임플란트 판매로 인해 강력한 성장을 누리고 있습니다. Coloplast는 최근 FDA가 소송의 대상이 된 질내 수복을 위한 수술용 메쉬 판매를 중단하라고 FDA와 주요 라이벌인 Boston Scientific(BSX)에 명령한 후 이 사업의 매각을 고려했습니다. 그러나 회사는 궁극적으로 중재적 비뇨기과 사업을 유지하기로 결정했습니다.

CLPBY는 지난 몇 차례의 중간 배당에 맞춰 반기 중간 배당을 선언했습니다. Coloplast가 일반적으로 연말 배당금을 인상하기 때문에 24년 연속 배당금을 인상할지 여부를 알아보려면 2020년 말까지 기다려야 합니다.

이콜랩 (ECL, $200.66) 식품, 건강 관리, 석유 및 가스를 포함한 여러 산업에 수처리 및 기타 산업 규모 유지 관리 서비스를 제공합니다. 실질적으로 말해서 이 회사의 제품은 해양 석유 생산에서 전자 제품 연마, 상업용 세탁에 이르기까지 모든 것을 최적화하는 데 도움이 됩니다.

그러나 이콜랩의 재산은 산업적 수요가 변동함에 따라 시들해질 수 있습니다. 예를 들어 에너지 회사가 지출을 줄이면 ECL은 소진을 느낄 것입니다.

그러나 장기적으로 이 배당금 귀족의 주식은 입증된 승자였습니다. 주식은 배당금을 포함하여 지난 10년 동안 16.5%의 연간 수익률을 제공했으며 S&P 500은 13.8%였습니다. 이는 28년 연속 배당금 증가 덕분입니다. 회사의 가장 최근 인상은 ECL이 분기별 배당금을 주당 47센트로 2% 인상한 12월에 이루어졌습니다.

스위스 초콜릿 제조사 Lindt &Sprungli (LDSVF, $7,923.00)는 프리미엄 품질의 초콜릿 분야의 세계적인 리더입니다.

이 회사는 미국과 유럽 전역의 12개 공장에서 초콜릿을 제조하고 120개국에서 410개의 소매점을 운영하며 판매를 기록하고 있습니다. 미국 소비자들은 회사의 Lindt, Ghirardelli 및 Russell Stover 브랜드를 구매하고 Lindt를 프리미엄 초콜릿 시장 1위, 미국 초콜릿 시장 전체 3위로 만들었습니다.

Lindt는 여행 소매업체, 자체 매장 네트워크, 식품 서비스 제공업체 및 일부 식료품 시장의 판매에 타격을 입힌 전염병으로 인해 타격을 받고 있다고 말했습니다. 불확실성에도 불구하고 회사는 중장기 성장 목표를 유지했을 뿐만 아니라 회사의 175번째 생일을 축하하는 3월에 배당금을 75%까지 늘렸습니다.

셔윈-윌리엄스 (SHW, $583.80)는 2017년 Valspar를 110억 달러에 인수한 덕분에 세계에서 가장 큰 페인트, 코팅제 및 주택 개조 회사 중 하나입니다.

이 회사는 코로나바이러스 위기에 빠르게 적응하여 커브 사이드 픽업을 구현하고 전자 상거래 플랫폼에 더 많이 의존하고 있습니다. 매출이 여전히 압박을 받고 있지만 북미 지역 건축 사업의 수요 개선이 타격을 완화하는 데 도움이 되고 있습니다.

장기적으로 분석가들은 견실한 이익 성장을 기대합니다. S&P Capital IQ가 설문 조사한 분석가들은 향후 3~5년 동안 수입이 연평균 거의 10% 성장할 것으로 예상합니다.

SHW는 안전과 관련하여 최고의 배당주 중 하나입니다. Sherwin-Williams는 2월 중순에 18.6% 증가한 것을 포함하여 1979년 이후 매년 배포를 개선했습니다. 한편, 수익의 27%만 배당금으로 지급합니다.

신타스 (CTAS, $266.88) 아마도 회사 유니폼을 제공하는 것으로 가장 잘 알려져 있을 것입니다. 그러나 이 회사는 유지 관리 용품, 타일 및 카펫 청소 서비스, 심지어 규정 준수 교육도 제공합니다. 따라서 일부 투자자들은 이를 고용 성장에 대한 내기로 간주합니다.

거기에 뭔가가있을 것입니다. 결국, 주식은 지난 5년 동안 236%의 총 수익률을 제공했지만 S&P 500의 경우 68%에 불과했습니다.

물론 수천만 명의 미국인이 실업자가 됨에 따라 COVID로 인한 경기 침체는 자연스럽게 CTAS 주식에 영향을 미쳤습니다. 주가는 주식 시장 저점에 의해 가치의 거의 절반을 잃었고, 여전히 강세장 고점에서 약 12% 떨어져 있습니다.

노동 시장이 어떻게 되든 상관없이 Cintas는 배당금 지급자로서 확고합니다. 회사는 1983년 기업공개 이후 매년 배당금을 인상했습니다. 가장 최근에 CTAS는 10월에 연간 배당금을 주당 2.55달러로 24% 인상했습니다.

브라운-포먼 (BF.B, $64.80)는 세계에서 가장 큰 알코올 생산 및 유통 업체 중 하나입니다. Jack Daniel의 테네시 위스키와 핀란디아 보드카는 가장 잘 알려진 브랜드 중 두 가지에 불과하며 전자는 장기적인 성장을 주도합니다. 위스키는 미국 술꾼들 사이에서 점점 인기를 얻고 있으며 설문 조사에 따르면 Jack Daniel's가 선두를 달리고 있습니다. 특히 Herradura 및 El Jimador 브랜드를 특징으로 하는 Brown-Forman의 데킬라 판매도 증가하고 있습니다.

세계 최고의 배당주와 달리 공개적으로 거래되는 BF.B 주식은 기업 문제에 대해 발언권이 없습니다. 그들은 투표권이 없습니다. 없음. 그 권력은 의결권이 있는 A급 주식의 대부분을 소유하고 있는 브라운 가문에 있습니다.

다행히도 회사의 이익 성장과 배당금으로부터 여전히 이익을 얻을 수 있습니다. 그 지불금은 36년 연속 증가했으며 74년 동안 중단 없이 전달되었습니다. 가장 최근에 Brown-Forman은 배당금을 5% 인상하여 2019년 11월 주당 17.43센트로 인상했습니다.

의료 기기 제조업체 Becton Dickinson (BDX, $257.37)는 2015년 같은 업계의 보완 업체인 CareFusion을 인수하면서 크게 성장했습니다. 그런 다음 2017년에는 전염병 치료 분야에서 강력한 위치를 차지하고 있는 또 다른 의료 제품 회사인 Dividend Aristocrat C.R. Bard와 240억 달러의 거래를 성사했습니다.

인슐린 주사기에서 세포 분석 시스템에 이르기까지 모든 것을 만드는 이 회사는 중국을 포함한 미국 이외의 시장에서 주도할 성장을 점점 더 모색하고 있습니다. S&P Capital IQ에 따르면 분석가들은 BDX가 향후 5년간 연평균 6.5%의 수익 성장률을 보일 것으로 예상합니다.

BDX의 마지막 인상은 2019년 11월에 발표된 2.6% 인상으로 연간 배당 성장률을 50년 가까이 연장했습니다. 그 실적은 불안한 소득 투자자에게 마음의 평화를 제공해야 합니다.

캐리어 글로벌 (CARR, $24.89)는 이 최고의 배당주 목록에 새로 추가된 몇 안 되는 종목 중 하나입니다.

Carrier는 난방, 환기 및 공조(HVAC), 냉동, 화재 및 안전의 세 가지 사업 부문을 보유한 기후 제어 시스템의 거대 기업입니다. 이 회사는 160개국에서 53,000명의 직원을 고용하고 있습니다.

Carrier Global은 한때 기업 모회사인 United Technologies를 기준으로 배당 귀족 명단을 작성했습니다. United Tech는 2020년 4월 Raytheon과 합병될 때까지 배당금 귀족이었습니다. Carrier Global은 합병의 일환으로 United Technologies(현재 Raytheon Technologies)에서 분사되었습니다.

이제 독립된 회사는 6월 초 주당 8센트의 배당금을 약속하면서 첫 번째 배당금을 선언했습니다. CARR은 United Technologies의 일원이 된 시간을 포함하여 25년 이상 동안 매년 배당금을 인상해 왔습니다.

국제 워싱턴주 (EXPD, $77.58) 2020년 1월에 Aristocrats에 합류하여 25년 동안의 배당 성장을 가렸습니다. 이 물류 회사는 지난 5월에 반기 배당금을 주당 50센트에서 52센트로 인상했습니다.

EXPD 주식은 올해 대유행에도 불구하고 S&P 500을 능가하는 비교적 좋은 흐름을 유지했습니다. "COVID-19의 영향은 계속해서 글로벌 경제 환경에 막대한 영향을 미치고 있습니다. 수요와 공급, 매수/매도 모두 "라고 CEO Jeffrey Musser는 5월 보도 자료에서 말했습니다.

그러나 과거가 프롤로그라면 EXPD는 배당금에 전념할 것입니다. 지불금 비율이 30% 미만이면 연속 기록을 유지할 수 있는 충분한 자원이 있음을 나타냅니다.

맥코믹 (MKC, $185.91) - 같은 이름의 허브, 향신료 및 기타 향료 브랜드와 Old Bay, Frank's RedHot, French's 등을 책임지고 있는 이 회사는 지난 3년 동안 매출 성장을 견인하기 위해 규모를 키워왔습니다.

이러한 거래도 성과를 거두고 있습니다. MKC는 COVID-19에 대한 불확실성으로 인해 올해 초 연간 전망을 끌어야 했지만, 2분기 매출이 8% 증가하고 이익이 거의 27% 증가하는 등 2020년에도 여전히 강력한 운영 결과를 보여주고 있습니다.

애널리스트들은 향후 5년 동안 연평균 5% 이상의 수익 성장을 기대하고 있습니다. 이는 95년 연속 지급되고 34년 동안 매년 인상되는 McCormick의 배당금을 뒷받침해야 합니다. 가장 최근에 11월에 회사는 배당금을 거의 9% 인상하여 주당 62센트로 인상했습니다. 이는 지불한 금액의 거의 두 배입니다. 2012.

CEO인 Lawrence Kurzius는 보도 자료에서 "우리는 주주들에게 현금을 돌려주는 오랜 역사에 전념하고 있으며 또 다른 배당금 인상을 발표하게 된 것을 매우 자랑스럽게 생각합니다."라고 말했습니다.

덴마크의 노보자임 (NVZMY, $58.48) 다양한 방법으로 사용되는 산업용 효소와 미생물을 개발합니다. 작물 수확량을 늘리고 동물 건강을 개선하며 베이커리 제품의 신선도를 높이고 섬유 생산 시 화학 물질 사용을 줄이고 의류 얼룩을 제거하고 폐수를 처리합니다.

이 회사는 전 세계적으로 56억 명의 사람들이 매주 Novozymes 효소가 포함된 제품을 사용하는 것으로 추산되는 엄청난 영향력을 가지고 있습니다.

Novozymes는 신흥 시장, 특히 가정용품 및 식음료 부문에서 사업을 확장하고 있습니다. 이 회사는 2018년에 태국, 인도네시아, 필리핀, 케냐에 사무소를 설치했으며 터키에는 아프리카 및 중동 고객을 위한 제품을 개발할 혁신 및 기술 센터를 열었습니다.

Novozymes는 매년 배당금을 제공하며 2019년 배당금은 전년도보다 5% 높았습니다. 이는 19년 연속 상승세에 좋은 결과이며 유럽 최고의 배당주 중 하나가 되었습니다.

Anyone who has spent time staring at the buttons in an elevator is familiar with Otis Worldwide (OTIS, $56.98). The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment.

Like Carrier Global, Otis was spun off of United Technologies as part of the Raytheon merger in spring 2020. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century.

Analysts expect the company to generate average annual earnings growth of 8% over the next three to five years.

Following its 2013 spinoff of AbbVie – another Dividend Aristocrat on this list that we'll discuss in a moment – Abbott Laboratories (ABT, $93.04) focused on branded generic drugs, medical devices, nutrition and diagnostic products. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices.

Additionally, ABT is "at the front-line of COVID diagnostic technology and information gathering," says Janney Montgomery Scott, which has no rating on the stock.

The company has been expanding by acquisition as of late, including medical-device firm St. Jude Medical and rapid-testing technology business Alere, both snapped up in 2017.

Abbott Labs, which dates back to 1888, first paid a dividend in 1924. Meanwhile, its dividend growth streak is nearing half a century. Its most recent improvement to the payout came in December – a 12.5% upgrade to 36 cents per share.

린데 (LIN, $225.95) became a Dividend Aristocrat in late 2018 after it completed its merger with Praxair, which itself was added to the illustrious list of the S&P 500's best dividend stocks for income growth in January 2018. The $90 billion tie-up of Linde and Praxair created the world's largest industrial gasses company.

Prior to the merger, Praxair had raised its dividend for 25 consecutive years. Linde, now headquartered in Dublin, had raised its dividend every year since 2014. The combined company is expected to continue to be a steady dividend payer, too. Its most recent hike was in late February – a 10% bump to 96.3 cents per share.

Analysts project the multinational industrial firm's profits to increase at an average annual rate of almost 9.7% over the next three to five years, according to a survey by S&P Capital IQ. A payout ratio of slightly more than 40% also gives Linde plenty of breathing room for future dividend growth.

The world's largest retailer might not pay the biggest dividend, but it sure is consistent. 월마트 (WMT, $130.68) has been delivering meager penny increases to its dividend since 2014, including 2020's bump to 54 cents per share. But that's been enough to maintain its 46-year streak of consecutive annual payout hikes.

Walmart boasts nearly 5,400 stores across different formats in the U.S., not to mention another 5,800 stores across dozens more banners in 26 other countries.

But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon.com (AMZN). The company's U.S. e-commerce sales grew 41% year-over-year in its most recent quarter, boosted by demand for groceries amid the coronavirus crisis. And it recently announced a "Walmart+" service in July to battle Amazon Prime.

Sage Group (SGPYY, $33.24) is a U.K.-based technology company that's among the leaders in enterprise software. The company provides specialized software used for accounting, financial management, enterprise planning, HR, payroll and payment processing. Approximately half of U.K. businesses use Sage software to pay their workers.

The company has faced challenges recently as it tries to shift its customers to the cloud. It has warned of short-term software and software-related services (SSRS) declines as it transitions toward subscription and cloud-based alternatives.

Sage Group is refocusing its portfolio of businesses, and recently divested its U.S. payroll processing business and Sage Pay business unit. The company said it would issue a capital return of roughly $300 million in sale proceeds to investors.

Like most European Dividend Aristocrats, Sage Group pays dividends semiannually. Its 2020 interim payout was 2.4% higher than the year-ago period, setting it up for another year of uninterrupted dividend growth.

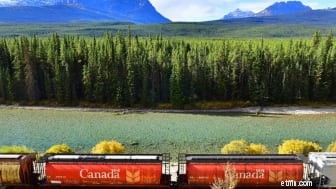

Canadian National Railway (CNI, $89.61) is the second-largest publicly traded North American railway. It boasts a network of roughly 20,000 route miles serving more than $250 billion worth of goods annually across Canada, the American Midwest and down to the Gulf of Mexico.

The railroad operator is one of Canada's top dividend stocks, as it has improved its payout every single year since going public in 1995. The dividend has grown by 16% annually on average during that time – one of the most robust rates among the nation's income plays.

The June payout of 57.5 Canadian cents per share represented year-over-year growth of 7.2%.

Clorox (CLX, $229.76), whose brands include its namesake bleaches, Glad trash bags and Hidden Valley salad dressing, received a tremendous tailwind from COVID-19. While many companies hemorrhaged sales during the outbreak, Clorox's biggest challenge was keeping up with demand for germ-killing products such as its disinfecting wipes.

The bottom line is that after years of disappointing share-price performance, Clorox stock is killing it in 2020. The stock is up nearly 50% for the year-to-date.

Clorox has increased its payout every year since 1977, most recently in May 2020 when it climbed 47% to $1.16 per share. A payout ratio of roughly 60% of Clorox's earnings signals that future payout increases might be modest, but the dividend appears plenty safe.

U.K. firm Diageo (DEO, $141.63) is a global alcoholic beverage company with sales in more than 180 countries. The company owns many top-selling liquors, including Johnnie Walker whisky, Crown Royal, Captain Morgan rum, Smirnoff vodka, Tanqueray and Gordons gin, Bailey's liqueur and Guinness beer.

Last August, Diageo ventured into the non-alcoholic beverage segment by acquiring a stake in Seedlip, the world's first distilled non-alcoholic spirits brand. Seedlip beverages are found in more than 7,500 bars, restaurants and hotels in 25 countries.

Diageo aims to accelerate the growth of its higher-margin premium brands in its portfolio, and it's doing so by trimming non-core brands. It recently shed 19 such brands, including Seagram's VO Canadian whisky and Goldschlager schnapps.

Dividends, paid semiannually, have been issued consistently since 1998, and it's among the European Dividend Aristocrats that have grown payouts for more than two decades. Diageo set itself up for a 22nd consecutive year of dividend growth with a 5% hike in its interim dividend to 27.41 pence per share.

Hormel Foods (HRL, $48.20) is about as reliable as they come when it comes to income investing. The packaged food company best known for Spam – but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces – has raised its annual payout every year for more than five decades.

Indeed, in November, Hormel announced its 54th consecutive annual dividend increase – a nearly 11% raise to 23.25 cents a share.

Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in 1928. Meeting analyst expectations – which currently are for a modest 3% average annual profit growth for the next five years – would go a long way toward keeping that streak alive.

PPG Industries (PPG, $107.04) makes coatings and paints for numerous industries, including aerospace, architecture, automotive and packaging. It's a business that always has some level of need, but 2020 has been tough so far given the global slowdown and uncertainty surrounding Boeing (BA), a major customer.

Longer-term, however, analysts remain optimistic that the company can generate steady growth.

PPG's profits are forecast to grow at an average annual rate of 5.8% for the next three to five years, according to S&P Capital IQ. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years.

PPG last maintained its membership among America's top dividend stocks in July 2019, when it announced a 6.3% increase to 51 cents per share.

항공 제품 및 화학 물질 (APD, $273.19) spent much of the past few years restructuring. 투자자들의 압력을 받아 전자 재료 사업부를 분사하고 성능 재료 사업부를 매각하는 등 무게를 줄이기 시작했습니다.

1940년으로 거슬러 올라가는 Air Products는 이제 레거시 산업용 가스 사업에 집중하는 모습으로 돌아온 날씬한 회사입니다. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. In fact, APD's May payout was 15.5% better than the year-ago dividend, marking the largest increase in company history.

"The board's decision to increase the dividend by over 15% reflects continued confidence in Air Products' strong financial position and cash flows," the company said in a news release. "In fiscal 2019, we paid nearly $1 billion dollars of dividends to our shareholders."

앨버말 (ALB, $78.89) which manufactures specialty chemicals such as lithium, was tapped to join the Dividend Aristocrats in January, having secured a streak of 25 years of dividend increases in 2019.

Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety.

The chemicals giant last hiked its dividend in February, by 5% to 38.5 cents a share. Meanwhile, its sub-30% payout ratio means ALB has the financial resources to keep hiking the payout.

"Consistently increasing our annualized dividend from 10 cents in 1994 to $1.47 in 2019, a 22% annual growth rate, reflects our steadfast commitment to returning cash to shareholders," CEO Luke Kissam said in early 2020. "We are confident in Albemarle's future, will remain disciplined in our capital allocation, and will continue to prioritize dividend growth."

A.O. 스미스 (AOS, $48.27), a manufacturer of commercial and residential water heaters, is a relatively recent addition to the Dividend Aristocrats, entering the club in 2018. In October 2019, it announced a 9% raise in its quarterly payout to 24 cents a share. AOS noted at the time that its five-year compound annual dividend growth rate was 24%.

Analysts expect the company's earnings to rise at a rate of 8% a year for the next five years, helped by the rollout of A.O. Smith water heaters at home-improvement chain Lowe's (LOW), as well as strength across the North American market.

A.O. Smith has upped the ante on its dividend annually for 27 consecutive years.

U.K.-based diversified industrial company Pentair (PNR, $38.45) completed the tax-free spinoff of nVent Electric (NVT) in 2017, allowing the company to focus on its water assets, operating in businesses such as Flow Technologies, Filtration &Process and Aquatic &Environmental Systems. It bulked up those operations with its January 2019 acquisition of Aquion for $160 million in cash.

Pentair has raised its dividend annually for 44 straight years, most recently by 5.6% to 19 cents a quarter, keeping its place among the world's top dividend stocks.

Analysts on average project long-term earnings growth of 3% a year, according to S&P Global Market Intelligence; that's a considerable slowdown from previous estimates, which you can chalk up to the COVID-inspired economic slowdown.

Still, a conservative payout ratio of 32% bodes well for future dividend growth.

Power- and hand-toolmaker Stanley Black &Decker (SWK, $139.92) has paid a dividend for 143 years on an uninterrupted basis, and it has improved that cash distribution annually for more than half a century, including a 4.5% increase to 69 cents per share in July 2019.

Analysts expect SWK to generate average annual earnings growth of 5.7% a year over the next half-decade, thanks to a strategy of growth through acquisitions and cost cuts.

Stanley Black &Decker bought Newell Tools – which includes the Lenox and Irwin brands – from Newell Brands (NWL) for $2 billion in 2016. In January 2017, it negotiated the purchase of the Craftsman tool brand from Sears Holdings (SHLDQ) for a total of $775 million over three years and a percentage of annual sales. Then in 2018, SWK announced the acquisition of IES Attachments for $690 million cash, and the $440 million purchase of Nelson Fastener Systems.

Stanley still is wheeling and dealing in 2020, announcing in January that it would buy Boeing-supplier Consolidated Aerospace Manufacturing for up to $1.5 billion.

Dover (DOV, $95.15) is arguably one of the very top dividend stocks in the world, given that its dividend-growth streak of 64 consecutive years is the longest on this list. Dover last raised its payout in August 2019, when it upped the quarterly dividend by 2% to 49 cents a share.

The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors.

It's not an exciting business, but it can be a remunerative one. And that's what counts.

"Dover has been displaying an impressive performance, aided by solid backlog across its segments, cost-reduction initiatives, acquisitions as well as new product development," Zacks Equity Research says. "Investors might want to hold on to the stock, at present, as it has ample prospects for outperforming peers in the near future."

애트모스 에너지 (ATO, $99.09), which distributes and stores natural gas, was added to the Dividend Aristocrats in January 2020. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana.

Atmos clinched its 25th year of dividend growth in November 2019, when it announced a 9.5% increase to 57.5 cents per quarter.

"The company has a sturdy capital expenditure policy in place, helping it enhance the safety and reliability profile of its natural gas pipeline," Zacks Equity Research notes.

Analysts surveyed by S&P Capital IQ forecast average annual earnings growth of 6.5% over the next three to five years. That doesn't sound exciting, but it's A-OK for dividend stocks in the utility sector.

Target (TGT, $118.86) might be the No. 2 discount retail chain after Walmart in terms of revenue, but it doesn't take a back seat to the behemoth from Bentonville when it comes to dividends.

Target paid its first dividend in 1967, seven years ahead of Walmart, and has raised its payout annually since 1972. The last hike came in June, when the retailer raised its quarterly disbursement by 3% to 68 cents a share.

Income investors can count on Target to keep hitting the mark for dividend growth thanks to a payout ratio of less than 48%. As for earnings growth? Analysts are looking for an average annual improvement of about 7% through the end of 2024 – not bad at all for a brick-and-mortar retailer.

Canadian media conglomerate Thomson Reuters (TRI, $67.59) is best known for its ownership of Reuters, the international news service but it holds a large portfolio of other businesses providing news and data for government, as well as the legal, tax compliance industries.

In February, Thomson Reuters increased its annual payout by about 5.6% to 38 cents per share, extending a dividend-growth streak that's more than a quarter-century old. Better still:TRI has a payout ratio of less than 43%, which means it has plenty of ceiling to keep the dividend hikes coming.

처브 (CB, $128.43) was added to the Dividend Aristocrats in January 2019. The insurance company last raised its payout in May, by 5% to 78 cents a share. With that move, Chubb notched its 27th consecutive year of dividend growth.

세계 최대 상장 손해보험 회사인 Chubb는 54개 국가 및 지역에서 사업을 운영하고 있습니다. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. Shareholders haven't had much to celebrate in 2020, however, with shares off more than 17% as of this writing.

Fortunately, Chubb is paying out just 37% of its earnings as dividends, so income investors can expect CB to remain on this list of top dividend stocks for years to come.

Colgate-Palmolive (CL, $73.68) sells a wide range of consumer staples brands including its namesake toothpaste and dish soap, as well as Speed Stick deodorant, Murphy cleaning products and Tom's of Maine personal-care products. Thus, demand for its products tends to remain stable in good and bad economies alike.

Those defensive characteristics are serving investors well during the pandemic. Shares in Colgate are positive for the year-to-date, up about 7%. The S&P 500, meanwhile, is still working on getting itself back into the green.

This Dividend Aristocrat's payout – which dates back more than a century, to 1895, and has increased annually for 58 years – should survive. CL last raised its quarterly payment in March, when it upgraded the payout 2.3% to 44 cents a share. Its dividend longevity makes Colgate as reliable an equity income holding as any.

Swiss giant Nestlé (NSRGY, $113.50) is the world's largest food and beverage company with more than 2,000 brands, 413 factories and sales in 190 countries. The company was founded more than 150 years ago as a developer of a breakthrough infant formula, and it merged with a milk company to create the Nestlé Group.

Nestlé household brands include Stouffer's frozen entries, Purina pet food, Perrier and Poland Spring water, Toll House baked goods, Nescafé coffee, Lean Cuisine meals, Häagen-Dazs ice cream, Gerber baby food, Coffee-Mate creamer, Cheerios cereal and numerous other recognizable names.

Nestlé is one of the oldest dividend payers among the European Dividend Aristocrats; the company has been paying cash distributions to shareholders since 1959. Its streak, meanwhile, is bordering on a quarter-century.

Automatic Data Processing (ADP, $147.17) is the world's largest payroll processing firm, responsible for paying nearly 40 million employees and serving more than 810,000 clients across 140 countries.

ADP has unsurprisingly struggled in 2020 amid higher unemployment. Nonetheless, one of ADP's great advantages is its "stickiness." It's difficult and expensive for corporate customers to change payroll service providers. That competitive advantage helps throw off consistent income and cash flow. In turn, ADP has become a dependable dividend payer – one that has provided an annual raise for shareholders since 1975.

ADP raised its dividend for a 45th consecutive year in late 2019. The new payout of 91 cents per share is more than 15% fatter than the previous amount.

Founded in 1912, Illinois Tool Works (ITW, $174.06) makes construction products, car parts, restaurant equipment and more. While ITW sells many products under its namesake brand, it also operates businesses including Foster Refrigerators, ACME Packaging Systems and the Wolf Range Company.

In August 2019, Illinois Tool Works raised its quarterly dividend 7% to $1.07 cents a share. ITW says it returned $2.8 billion to shareholders in the form of dividends and share repurchases last year.

ITW has improved its dividend for 56 straight years. Its payout ratio of 55% is higher than many of the companies we've already covered, but it still leaves decent headroom for modest but steady increases for years to come.

Intertek Group (IKTSY, $69.05) is a British multinational product testing business that operates a network of more than 1,000 labs across 100 countries. Intertek Group provides quality and safety assurance testing to customers in the construction, health care, food production and transport industries.

Intertek Group envisions major business expansion opportunities through new customer wins and cross-selling, given that only $50 billion of the $200 billion testing worldwide market is currently outsourced.

Just note that Intertek's U.S.-listed ADRs are extremely thinly traded, sometimes only trading 100 shares or so every few days, if that. That means even small orders can significantly move the price. Consider using limit and stop-loss orders when dealing with this stock.

Look around a hospital or doctor's office – in the U.S. or in more than 160 other countries – and there's a good chance you'll see Medtronic's (MDT, $90.81) products. The maker of medical devices has compiled more than 47,000 patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons.

That patent haul isn't free. MDT spent $2.3 billion on R&D in 2019. But the company has plenty of cash left over for shareholders.

MDT aims to return a minimum of 50% of its free cash flow to shareholders through dividends and share repurchases. Most recently, in May, MDT lifted its quarterly payout by 7.4% to 58 cents a share. Its dividend per share has grown by 50% over the past half-decade and has grown at a 17% compounded annual growth rate over the past 43 years, Medtronic says.

With major brands such as Tide detergent, Pampers diapers and Gillette razors, Procter &Gamble (PG, $123.89) is among the world's largest consumer products companies. 경제가 요동치고 있지만 화장지, 치약, 비누와 같은 제품에 대한 수요는 안정적으로 유지되는 경향이 있습니다.

Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. At the moment, Procter &Gamble boasts 23 brands that generate at least $1 billion in annual revenues – and another 14 with sales of between $500 million and $1 billion.

That hardly makes P&G completely recession-proof, but it has helped fuel reliable payments for more than a century, making it one of the world's top dividend stocks from a longevity standpoint. The Dow component has paid shareholders a cash distribution since 1890 and has raised its dividend annually for 64 years in a row.

P&G last improved its payout in April, by 6% to 79.07 cents per share.

The world's largest hamburger chain also happens to be a dividend stalwart.

Changing consumer tastes will always be a risk, but McDonald's (MCD, $184.88) dividend dates back to 1976 and has gone up every single year since. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core.

Including dividends, McDonald's – a component of the Dow Jones Industrial Average – has generated a total return of 114% over the past five years. That beats the S&P 500 by about 58 percentage points.

MCD last raised its dividend in September 2019, when it lifted the quarterly payout by 7.8% to $1.25 a share. That marked its 43rd consecutive annual increase.

존슨 앤 존슨 (JNJ, $142.37), founded in 1886 and public since 1944, operates in several different segments of the health-care industry. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. It also manufactures medical devices used in surgery.

The Dow component is currently rushing to develop a vaccine for coronavirus – the pneumonia-like disease spreading rapidly in China. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. The health care giant last hiked its payout in April, by 6.3% to $1.01 a share, extending its streak of consecutive annual dividend growth to 58 years.

J&J's earnings growth should be more than sufficient to keep the streak alive. Wall Street's pros expect profits to increase at an average annual rate of 5.7%.

Asset managers such as T. Rowe Price (TROW, $127.27) have been losing market share to indexed funds of the type Vanguard offers. Assets under management have declined by $200 billion so far this year to $1 trillion and revenue is forecast to remain essentially unchanged in 2020.

Be that as it may, T. Rowe Price has improved its dividend every year for 34 years, and it boasts a lean 33.9% payout ratio that should keep the annual hikes coming. The company last raised its distribution in February, by 18.4% to 90 cents per share.

Kimberly-Clark's (KMB, $143.24) well-known brands include Huggies diapers, Scott paper towels and Kleenex tissues. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns.

Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. In January, KMB announced a 3.9% increase in the quarterly dividend, to $1.07 per share. The company notes that for its most recent full fiscal year, it generated $425 million in cost savings and returned $2.2 billion to shareholders through dividends and share repurchases.

Analysts polled by S&P Capital IQ expect KMB earnings to grow at an average annual rate of 6.3% over the next five years.

Like Coca-Cola, PepsiCo (PEP, $134.46) is working against a long-term slide in soda sales. 또한 무탄산 음료 제공을 확대함으로써 이에 대응했습니다. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business – the company owns Frito-Lay snacks such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid.

Last year, Pepsi struck deals to buy BFY Brands, the maker of PopCorners snacks, and South Africa-based Pioneer Foods, to widen its reach in the snacks industry. That should help prop up PEP's earnings, which analysts expect will grow at 4.9% annually on average over the next five years.

It also should help the company maintain its place among the world's top dividend stocks. Its streak reached 48 years in February after a 7.1% hike to $1.0225 per share.

국방 계약자 General Dynamics (GD, $141.97) is a relatively new member of the Dividend Aristocrats, having been added to the elite list of dividend growers in 2017.

관대한 군비 지출은 주주들에게 돌려주는 이 배당 주식의 꾸준한 현금 흐름을 촉진하는 데 도움이 되었습니다. In August 2019, the U.S. General Services Administration and the Defense Department awarded GD a $7.6 billion cloud contract. More recently, in December, the Pentagon awarded General Dynamics a $300 million U.S. defense contract to modernize and maintain the Navy's ballistic-missile submarine fire control systems.

General Dynamics has upped its distribution for 28 consecutive years. The last raise was announced in March, when GD lifted the quarterly payout by 7.8% to $1.10 a share. With a payout ratio of 34%, General Dynamics should have ample room for more dividend growth.

아플락 (AFL, $34.87) is a supplemental insurance company – popularized by the loud Aflac duck – with roots going back to 1955 that covers numerous workplace offerings, such as accident, short-term disability and life insurance.

In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3.7% to 28 cents per share.

'(Raising the dividend is) a recognition of the stability of our earnings and capital generation,' said CEO Daniel Amos in a press release. 'It also demonstrates our commitment to rewarding our shareholders.'

COVID has depressed analysts' enthusiasm for the company, however; they now expect Aflac to generate average earnings growth of just 1.6% a year for the next half-decade, according to S&P Global Market Intelligence. Fortunately, the payout is an extremely conservative 27% of profits, so it's more than safe for now.

Germany's Fresenius Medical Care (FMS, $42.49) provides dialysis services to some 340,000 patients worldwide through its network of nearly 4,000 dialysis clinics. The company also sells dialysis-related products and services to around 3.4 million patients worldwide. Much of the company's growth has come from acquisitions, which have recently included Sparsh Nephrocare, XENiOS, Cura Group, and NxStage Medical.

North America represents 70% of the company's revenues. However, last year, Fresenius Medical Care introduced a lower-priced dialysis machine in China that is specifically designed for emerging markets.

In May, the company said it expects no impact to its dividend from COVID-19, and it's proposing a dividend of 1.2 euros. That indicates a good chance the payout will be bumped higher in 2020.

Raytheon Technologies (RTX, $59.64), formerly known as United Technologies prior to their spring 2020 merger, has paid cash dividends on its common stock every year since 1936. Even better, it has raised its payout annually for 26 years.

The merged entity – minus Carrier Global and Otis Worldwide – declared its first dividend in April with a distribution of 47.5 cents a share.

Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID-19, they expect that it will nevertheless generate significant cash by 2022.

Most recently, Raytheon's missiles and defense business secured a $32.2 million contract from the Navy to work on Evolved Sea Sparrow Missiles (ESSM) Block 2.

VF Corp. (VFC, $60.74) is an apparel company with a large number of brands under its umbrella, including The North Face outdoor products, Timberland boots and Eastpak backpacks. It added to its brand portfolio with the acquisition of Icebreaker Holdings – another outdoor and sport designer – under undisclosed terms in April 2018.

Analysts expect average annual earnings growth of 7.8% for the next five years from this transforming company. In addition to picking up Icebreaker, the company also spun off Kontoor Brands (KTB), which includes Lee and Wrangler jeans, in 2019.

The company's last dividend increase came in October, when it raised the payout by 11.6% to 48 cents a share. Interestingly, Kontoor was forced to suspend its payout in May 2020.

Consumer products giant Unilever (UL, $54.21) sells food, beauty-care and personal-care products used by more than 2.5 billion consumers worldwide and generates revenues in more than 190 countries.

This is a dominant player across several product lines. Eighty-five percent of Unilever's 400-plus brands hold market-leading positions. Many of its brands are familiar to American consumers:Dove soap, Lipton tea, Hellmann's mayo, Breyer's and Ben &Jerry's ice creams, TRESemmé shampoo and Pond's and Noxzema skin softeners. Twelve of its brands exceed $1.1 billion in annual sales.

Unilever originally consisted of Dutch and U.K. subsidiaries, but the company consolidated its operations into its Dutch subsidiary last year. This operational streamlining is expected to reduce costs and make the business more agile.

So far in 2020, Unilever has not improved upon its 0.4104-euro payout.

Cincinnati Financial (CINF, $70.48) boasts one of the best income-growth streaks on this list of the world's top dividend stocks. On Jan. 31, the property and casualty insurer lifted its payout for a 60th straight year. CINF, whose offerings include life insurance, annuities, umbrella insurance and a wide range of business insurance products, improved its quarterly dividend by 5.7%, to 56 cents per share.

It's far too soon to worry about Cincinnati Financial extending its streak to 61 years, but earnings trends and free cash flow are taking a hit amid the economic downturn. The insurer had negative free cash flow of $3.2 billion for the quarter ended March 31. In the same quarter of 2019, the company had free cash flow of $436 million. Additionally, CINF is expected to post a net loss this year of $4.80 a share vs. a year-ago profit of $4.20.

That has forced analysts to rethink their outlooks. Cincinnati Financial is currently expected to deliver an annual average profit decrease of 8.7% over the next three to five years, according to S&P Capital IQ data, though that's subject to revision if the country's COVID-19 situation (and the economy) improves.

Emerson Electric (EMR, $59.77) makes a wide variety of industrial products, ranging from control valves to electrical fittings.

The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. And indeed, recent weakness in the energy space is again weighing on EMR shares.

Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. And they're forecasting decent earnings growth of about 7.8% annually on average over the next three to five years.

Emerson has paid dividends since 1956 and has boosted its annual payout for 63 consecutive years, including its last increase – 2% to 50 cents per share – in November 2019. Over the past 12 months, EMR has returned $1.2 billion to shareholders through dividends, and roughly the same amount in stock buybacks.

Danish firm Novo Nordisk (NVO, $65.44) is the world leader in medicines for diabetes and obesity-related disorders. The company has a 47% share of the insulin market and a 27% share of the total market for diabetes care (which includes insulin).

North American operations account for roughly half of sales. Other significant markets include Europe, China and the Middle East. Insulin products contribute 50% of revenues, other diabetes products and obesity products contribute 34% of sales, and biopharmaceutical medicines for bleeding and growth hormone-related disorders round out the remaining revenues.

Because diabetes is a chronic condition, Novo Nordisk's insulin sales create steady recurring cash flow. The company recently launched its new line of GLP-1 therapeutics for treating type-2 diabetes that is already approaching blockbuster drug status. GLP-1 is a naturally occurring hormone that induces insulin secretion. GLP-1 therapeutics have rapidly grown to become 17% of the worldwide diabetes market, and Novo Nordisk is the market leader with a 47% global market share in this new niche.

NVO pays dividends semiannually.

French drugmaker Sanofi (SNY, $50.28) is known for diabetes drugs such as Lantus, which recently came off-patent, and is working to become a bigger player in cancer, immunology and rare blood disorders. In 2018, the company acquired Bioverativ and Ablynx, which develop drugs for hemophilia.

Sanofi also advanced its drug Dupixent, for new treatment indications in dermatitis. Dupixent creates the platform for Sanofi's expansion in immunology. Developed in partnership with Regeneron (REGN), Dupixent is on track to generate $2 billion of annualized revenues, good for blockbuster status.

Under a new CEO recruited from rival Novartis, Sanofi is now focusing on sourcing more new drugs internally. It's also redirecting spending toward a slate of experimental oncology drugs. Roughly half its pipeline consists of internally derived molecules; Sanofi hopes to bring that number up to 70% over the next five to 10 years.

Sanofi's dividends have improved every year for more than a quarter-century, putting it among Europe's top dividend stocks. Its 2019 annual payout, of 3.15 euros per share, was approved in April 2020 and represents a 2.6% uptick.

Sysco (SYY, $52.31), a food services and restaurant supply company, has long generated sales growth by making acquisitions. And prior to COVID-19 shutting down food preparation establishments, stadium concessions and the like, Sysco was able to generate plenty of growth on its own, too.

This combination of organic and M&A-based growth has produced a steady ramp-up in revenues for years. Where that goes from here remains to be seen. Analysts expect average earnings growth of 5.5% annually over the next half-decade, down from more than 11% at the start of 2020 thanks to effects from COVID-19.

That should nonetheless allow Sysco to maintain its spot among the best dividend stocks for payout growth. SYY's streak currently sits at half a century and includes a 15% hike to 45 cents per share, announced in November 2019.

It's not easy being an auto parts manufacturer, but if any company can handle the tariff issues, it's Magna International (MGA, $45.85).

A big player in electric-vehicle development, Magna joined with BMW and Andretti Motorsport as a partner in their electric-vehicle racing team in 2018. The alliance allows Magna to learn more about how its mobility solutions business can help cities solve their mobility challenges.

MGA raised its dividend from 36.5 cents per share to 40 cents in early 2020 to extend its streak to 11 years. Magna paid dividends of $121 million during the three months ended March 31 and spent another $192 million on stock buybacks.

코카콜라 (KO, $45.15) has long been known for quenching consumers' thirst, but it's equally effective at quenching investors' thirst for income. The company's dividend history stretches back to 1920, and the payout has swelled for 58 consecutive years. The last hike, announced in February 2020, was an admittedly modest one, however, at just 2.5% to 41 cents per share.

시장 조사에 따르면 미국 탄산 음료 시장이 10년 이상 쇠퇴함에 따라 코카콜라는 현금 흐름을 유지하기 위해 제품 라인업에 생수, 과일 주스 및 차를 추가함으로써 대응했습니다. In addition to the namesake Coca-Cola brand, KO also sports names such as Minute Maid, Powerade, Simply Orange and Vitaminwater.

The latest big-name deal made by Coca-Cola came in 2018, when it acquired Costa Limited, which owns the popular Costa Coffee brand that operates in more than 30 countries. For 2020, KO hopes to make a splash with a caffeinated sparkling water lineup, as well as Coca-Cola-branded energy drinks.

Fortis (FTS, $38.18) owns 10 utility operations in Canada, U.S. and the Caribbean, providing gas and electricity to more than 3.3 million customers. It is one of the top 15 utilities in North America. In the company's 31-year history, its asset base has grown from $300 million at its launch in 1985 to $50 billion today.

The company gets 92% of its earnings from regulated utilities, which means those profits are fairly stable and benefit from steady rate increases. It's easy to see why Fortis is among Canada's top dividend stocks, at 45 consecutive years of dividend increases.

Over the past decade, Fortis has kept its dividend payout ratio between 61% and 73%, ensuring it's not stretching to make its payments. Its last hike was a 6.1% bump in its December 2019 dividend, to 47.75 Canadian cents per share.

Swiss health-care company Novartis (NVS, $87.01) is known for its blockbuster drugs Cosentyx (arthritis) and Entresto (heart failure). Under a new CEO, the company has been pivoting toward more cutting-edge gene therapies such as Zolgensma, which treats spinal muscular atrophy. It's one of the first gene therapies to go on sale in the U.S. and carries a hefty $2.1 million price tag. Novartis acquired the drug through the $8.7 billion purchase of the drug's developer, AveXis.

Acquisitions in gene therapies and radiopharmaceuticals (drugs that carry radioactive particles to cancer tumors) build on earlier investments in Novartis' new CAR-T gene therapy, in which blood cells extracted from a patient are modified to attack cancer and then re-infused into the patient.

Novartis' annual dividend, which has grown for more than two decades, is inching along, including a 3.5% hike for 2019. (Like many European payers, Novartis' dividends for a particular year are actually declared in the following year; 2019's dividend was declared in 2020, for instance.)

Archer Daniels Midland (ADM, $39.38) processes ingredients for food and feed, including corn sweeteners, starches and emulsifiers such as lecithin. It also has a commodities trading business. It's a truly global agricultural powerhouse, too, boasting customers in 170 countries that are served by 450 crop procurement locations, as well as more than 330 ingredient plants.

It's a slow-growth business, however. Analysts surveyed by S&P Capital IQ expect ADM's earnings to rise at an average annual rate of just 6% for the next five years.

Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. On Jan. 30, ADM raised its quarterly dividend by a little less than 3% to 35 cents per share, marking its 46th consecutive year of dividend hikes.

Real estate investment trusts (REITs) such as Essex Property Trust (ESS, $225.33) are required to pay out at least 90% of their taxable earnings as dividends in exchange for certain tax benefits. Thus, REITs are well known as some of the top dividend stocks you can buy.

ESS was added to the Dividend Aristocrats this year. The REIT, which invests in apartments, primarily on the West Coast, hit the public markets in 1994 and has been hiking its payout ever since.

The most recent increase came in February 2020, when ESS lifted the quarterly dividend 6.5% to $2.0775 per share.

Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation, too. However, losses in 2020 have been far deeper than the S&P 500 as investors worry about the prospects for unpaid rents later this year.

산업 대기업 3M (MMM, $152.85), which makes everything from adhesives to electronic touch displays, hasn't kept up its end of the bargain when it comes to being a defensive stock. Shares have underperformed the S&P 500 by a wide margin this year.

But 3M's troubles stretch farther back than 2020. MMM had been struggling for a while in part because of slower growth in China. And that was before the spread of coronavirus led to a Chinese lockdown, followed by damage to the rest of the global economy.

True, 3M continues to ramp up production of N95 respirators, but those aren't the kind of high-margin products that move the earnings needle.

However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate maintaining its status as one of the world's top dividend stocks over the long haul. While inclusion in the S&P 500 Dividend Aristocrats requires a minimum of 25 years of uninterrupted annual dividend growth, MMM has much more – its dividend has improved annually for 62 consecutive years, and the payout dates back more than a century. 3M's last hike was a 2% increase announced in February.

꾸준한 인수 흐름은 도매 의약품 및 의료 기기 유통업체 Cardinal Health에 도움이 되었습니다. (CAH, $49.36) become the giant that it is today.

More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. CAH said its Chinese supplier outsourced some of the surgical gown production work to a 'non-registered, non-qualified facility' where Cardinal couldn't assure its sterility.

That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. CAH's last big deal was completed in summer 2017, when it acquired Medtronic's Patient Care, Deep Vein Thrombosis and Nutritional Insufficiency business for $6.1 billion.

On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. The Dividend Aristocrat last raised its dividend in May, when it announced a small 1% increase to 48.59 cents per share.

Shareholders in Nucor (NUE, $40.45), the largest U.S. steelmaker, were hoping 2020 was the year in which business got back to normal after a few years of turbulence due slower global growth and tariffs.

So much for that. Shares are down by more than a quarter for the year-to-date as the global economy struggles against the effects of COVID-19.

Whatever may come, investors have plenty of proof that Nucor is dedicated to growing its dividend. Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in 1973. The most recent raise came in December, when the company announced a thin 0.6% improvement in its dividend, to 40.25 cents per share.

Nucor has returned approximately $6 billion in cash to its stockholders in the form of dividends and share repurchases over the past decade, the company says.

Consolidated Edison (ED, $72.48) is one of the nation's largest utility stocks by market value. Founded in 1823, it provides electric, gas and steam service for the 10 million customers in New York City and Westchester County.

Like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades.

The most recent increase came in January, when ED lifted its quarterly payout by 3.4% to 76.5 cents per share.

Amcor (AMCR, $10.51) is a pretty boring company. 식품, 음료, 제약, 의료, 가정 및 개인용품을 포함하여 생각할 수 있는 모든 산업에 대한 다양한 포장 제품을 설계, 제조 및 판매합니다.

Sometimes boring is beautiful, though, and that's the case with Amcor. It was named to the list of payout-hiking dividend stocks at the start of 2020 after its June 2019 acquisition of Bemis. Bemis, which fell out of the S&P 500 index and thus the Aristocrats in 2014, rejoined by merit of its merger with Amcor.

The analyst community expects the company to deliver average annual earnings growth of 8%. Also, with a yield of more than 4%, AMCR is one of the more generous Dividend Aristocrats.

Belgian holding company Groupe Bruxelles Lambert (GBLBY, $7.50) is one of Europe's largest investment firms, with sizable stakes in industry-leading companies such as Adidas (ADDYY), Total SA (TOT) and Pernod Ricard (PDRDY). The company also owns Sienna Group, which invests across many of the world's leading fund managers.

Groupe Bruxelles Lambert's net asset value sits around $18 billion currently.

The company has improved its payout for 16 consecutive years, while delivering 11.5% annualized total shareholder return from 2012-19, beating an 8.4% return for the Stoxx Europe 50 during the same time period. The lightly traded GBLBY ADR shares have struggled in 2020, however, with a 27% decline that has boosted its yield well above 4%.

Royal Bank of Canada (RY, $68.48) is one of Canada's largest banks, and among the largest in the world by market capitalization. It boasts more than 16 million customers and operates in 36 countries including the U.S. and (naturally) Canada.

RBC was named Retail Banker International's North America Retail Bank of the Year in 2019. And J.D. Power has named it the highest or second-highest for customer satisfaction in each of the past four years.

Over the past 10 years, Royal Bank of Canada paid out more than C$35 billion in dividends to its shareholders, growing its payment by an average of 12% a year. The company announced its 10th consecutive dividend increase in February when it raised its payout 5% to $1.08 per share.

Tracing its roots back to a single drugstore founded in 1901, today's Walgreens Boots Alliance (WBA, $40.12) was created by a merger with Alliance Boots – a Switzerland-based health and beauty multinational – in 2014.

Walgreens Boots Alliance and its predecessor company, Walgreen Co., have paid a dividend in 350 straight quarters (more than 86 years) and have raised the payout for 44 consecutive years, the company says.

Although WBA has boosted its dividend every year for more than four decades – most recently, in July 2019, it declared a hike of 4% – investors are waiting to see if it will keep its streak alive for a 45th year.

Algonquin Power &Utilities (AQN, $12.96) is a Canadian utility company that operates under two subsidiaries. Liberty Utilities provides water, electricity and gas utility services to more than 750,000 customers in 12 states, including Illinois, Texas, California and Massachusetts. Liberty Power, meanwhile, owns an interest in more than 35 clean-energy facilities in the U.S. and Canada.

AQN is in the midst of a five-year, $7.5 billion capital plan that will see it invest between $1.5 billion and $1.7 billion in 2019 on projects across North America, including a three-farm, 600-megawatt wind generation project in the U.S. Midwest.

Algonquin last raised its quarterly dividend by 10% to 15.51 cents per share for its July payment.

As mentioned earlier, AbbVie (ABBV, $96.83) was spun off from Abbott Laboratories in 2013, and like its parent, it carries a longstanding dividend-growth streak that allowed it to remain among the Dividend Aristocrats.

Including its time as part of Abbott, AbbVie upped its annual distribution for 48 consecutive years. The last hike was a 10.3% bump to $1.18 per share for the dividend paid out in February 2020.

The firm closed its $63 billion acquisition of Botox-maker Allergan in May. The deal goes a long way toward bolstering AbbVie's current lineup of blockbuster drugs such as Humira – a rheumatoid arthritis drug that has been approved for numerous other ailments. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel.

That added earnings power should keep AbbVie among the world's top dividend stocks.

부동산 소득 (O, $56.99) is another REIT with a beaten-down share price and a long history of delivering steady income. But there's another aspect to this stock that might suit certain income investors:Realty Income is a rare breed of monthly dividend stocks.

The company owns more than 6,500 commercial real estate properties that are leased out to more than 630 tenants – including Walgreens, 7-Eleven, FedEx (FDX) and Dollar General (DG) – operating in 51 industries. These are mostly retail-focused businesses with strong financial health.

Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. Indeed, O shares have delivered 599 consecutive monthly dividends to date, including 91 consecutive quarterly increases.

The current 23.35-cent distribution is about 3% larger than it was a year ago.

The name Franklin Resources (BEN, $21.10) might not be well-known among investors; however, along with its subsidiaries, it's called the more familiar Franklin Templeton investments. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings.

Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds.

The asset manager has raised its dividend annually since 1981, including a 4% hike to 27 cents per share quarterly announced in December 2019.

Federal Realty Investment Trust (FRT, $79.95) is another REIT whose share-price has collapsed as a result of the coronavirus lockdown. Indeed, the stock fell by a third during the first half of 2020.

When it comes to dividends, however, few stocks have been steadier than FRT.

The trust, which owns retail and mixed-use real estate across 12 states, as well as the District of Columbia, has hiked its payout every year for more than half a century, making it one of the top dividend-paying stocks in real estate.

FRT has registered roughly 59% dividend growth over the past decade. That includes a modest 2.9% improvement to the cash distribution announced in August 2019.

TC Energy (TRP, $41.77), formerly known as TransCanada, is a leading North American energy infrastructure company that began life in 1951 as TransCanada Pipelines Limited. TransCanada announced the name change early in 2019 with the official transition on May 3, to reflect that it has operations across North America, and not just in Canada.

The Calgary-based company owns one of the largest natural gas pipeline networks in North America (57,500 miles of pipeline), capable of moving 25% of the continent's demand for natural gas. In addition, its Keystone liquids pipeline system transports approximately 20% of Western Canada's crude oil exports.

Like many energy stocks, TRP has struggled in 2020, off nearly 30% year-to-date. Most recently, the company's stock was hobbled by a Supreme Court ruling against its Keystone XL oil-sands pipeline.

TC Energy is on track to lift its 2020 full-year dividend to C$3.24 from C$3.00 a year ago. The company intends to expand the dividend by 8% to 10% annually through at least 2021.

BCE (BCE, $40.58) is Canada's largest communications company with annual revenue of $22.7 billion. It generates approximately 54% of its sales from wireline broadband and TV, 35% from wireless, and the remaining 11% from the company's media operations.

The company's fiber-optic network is 240,000 kilometers in length – the largest in Canada – delivering internet, phone and TV to more than 9.2 million locations across seven provinces.

BCE last raised its annual dividend in February, when it boosted the payout by 5% to 83.25 Canadian cents per share.

셰브론 (CVX, $85.23) is an integrated oil giant that also has operations in natural gas and geothermal energy. And like its competitors, Chevron hurt when oil prices started to tumble in 2014. The energy major was forced to slash spending as a result, but – reassuringly – it never slashed its dividend.

Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. Things have stabilized a bit, however. Kiplinger forecasts that prices will range from $35 to $40 a barrel in the months ahead. That's not great, but it's a far better environment than what energy companies were dealing with earlier this year.

With more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. The most recent hike came in January, when CVX lifted its quarterly dividend by more than 8% to $1.29 per share.

Canadian Imperial Bank of Commerce (CM, $67.36) is the smallest of Canada's five major banks. It greatly expanded its U.S. business in 2017, however, by purchasing Chicago-based PrivateBancorp for $5 billion in cash and shares.

Now, the bank serves 10 million clients in Canada, the U.S. and across the globe via various banking arms, as well as wealth management and capital markets.

CIBC, like a few other Canadian dividend stocks, raised its payout twice in 2019 – from $1.36 to $1.40, and then again to $1.44. The most recent raise declared in May, when the bank increased the dividend by 1.4% to $1.46 a share.

Bank of Nova Scotia (BNS, $40.88) went on a buying binge last year, spending almost C$7 billion on acquisitions both in Canada and Latin America. The deals haven't helped the stock much in 2020, however, as shares have tumbled on weak oil prices and cold Canadian economy.

The bank declared its initial dividend in 1833 and payments have been made continuously since. Even better for long-term investors, BNS has increased the dividend in 43 of the past 45 years. Its current dividend growth streak is nine years.

A reminder:Qualification for aristocracy in Canada is a little different and less stringent than the U.S. version. Most importantly, a stock only needs to increase its annual payout for five consecutive years to become a member of the Canadian Dividend Aristocrats, and can even maintain the same dividend for two consecutive years within that time.

People's United Financial (PBCT, $11.13) is a rare banking play in this collection of dividend stocks. The regional financial services firm – which operates more than 400 branches in Connecticut, New York, Massachusetts, Vermont, New Hampshire and Maine – has more than $60 billion in total assets. 유서 깊은 뉴잉글랜드 기관의 뿌리는 1842년으로 거슬러 올라갑니다.

PBCT was added to the Dividend Aristocrats in January 2019. Cut to April, and the firm hiked its dividend for a 27th consecutive year, by 1.4% to 184 cents per share.

Future increases could be modest, too. While the company's payout ratio of 56% is plenty safe, analysts expect modest annual earnings growth of just 2% on average over the next half-decade. Moreover, there currently is pressure on banks to not overextend themselves financially via dividends and share repurchases.

통신주는 배당금과 동의어입니다. 고객은 매달 서비스 비용을 지불하므로 이러한 배당금에 대한 현금 흐름이 안정적입니다.

AT&T (T, $30.13) – the largest U.S. telecom company – is a prime example.

AT&T has raised its dividend on an annual basis for 36 consecutive years, and typically boasts one of the highest dividend yields in the S&P 500. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon (VZ). Together, the pair command almost 70% of the U.S. wireless subscriptions market, according to data from Statista.

But while AT&T might be among the world's top dividend stocks, its payout growth isn't exactly breathtaking. AT&T's most recent increase was a 2% uptick announced in December, to 52 cents per share. That continues a years-long streak of penny-per-share hikes.

British American Tobacco (BTI, $37.23) is the No. 2 cigarette maker in the world by sales, behind Philip Morris International (PM). The company operates in 180 countries and has a market-leading position in more than 50 countries. Cigarette sales are largely driven by five key brands:Dunhill, Kent, Lucky Strike, Pall Mall and Rothmans. BTI also added popular U.S. brands such as Newport, Camel and Natural American Spirit through the 2017 acquisition of Reynolds American.

Cigarette sales are declining, of course, and tobacco companies are relying on new product categories such as e-cigarettes and oral tobacco to generate growth. British American Tobacco owns two market-leading e-cigarette brands (Vype and Vuse) and several popular oral tobacco brands (Epok, Lyft and Velo). The company expects new product categories to contribute more than $6 billion of annual sales by 2024.

This European Dividend Aristocrat switched from semiannual to quarterly dividends in 2018. In May, BTI raised its quarterly payout by 3.6%.

Prudential (PUK, $60.54) spun off its U.K. and European operations last year to focus on expanding its Asia, U.S. and Africa business. Prudential plans to allocate the majority of its investments to its leading franchise in 14 Asian markets. Cash flow for growth will be generated by harvesting profits from its Jackson U.S. retirement products business.

In recent years, Asia and the U.S. have been Prudential's primary growth catalysts, generating 15% annual earnings and free cash flow growth over the past decade.

Prudential's Eastspring Investments Asian asset management business expanded its footprint in Thailand in September 2019 by acquiring a majority stake in the country's eighth largest mutual fund manager. The combined businesses will create Thailand's fourth largest asset manager and sixth largest bank, with 10 million retail customers.

Prudential declared its most recent dividend in March, which came to 25.97 cents per share.

Canadian Natural Resources (CNQ, $16.88) is one of the world's top independent energy producers, with natural gas, heavy crude oil and oil sands operations in North America and offshore operations in Africa and the U.K. It produces the oil equivalent of more than 1 billion barrels daily.

Canadian Natural Resources completed its acquisition of Devon Energy's (DVN) Canadian assets for C$3.8 billion in mid-2019. The deal made CNQ the eighth-largest oil producer in the world (excluding government-owned enterprises).

CNQ returned more than $2.6 billion to shareholders in 2019. Dividend payments came to approximately $1.7 billion, while it spent about $900 million on stock buybacks.

The company's April payout of 42.50 Canadian cents a share represented a year-over-year increase of 13.3%.

One of the big headwinds holding back Enbridge (ENB, $29.60) stock was a complex business structure in place to take advantage of tax loopholes available to master limited partnerships.

However, when the Federal Energy Regulatory Commission decided to put an end to the loopholes, which allowed MLPs to double their recovery of taxes, Enbridge decided to buy back all of its pipeline subsidiaries at the cost of C$11.4 billion.

Enbridge is one of Canada's top dividend stocks; it has paid a cash distribution for more than 65 years and has raised it annually for a quarter of a century. Most recently, in December 2019, the company announced a 9.8% increase in the quarterly dividend to 81 Canadian cents a share.

Pembina Pipeline (PBA, $23.52) is a leading North American energy infrastructure company based in Calgary, Alberta. The company's pipelines will soon have the capacity to transport 3.2 million barrels of oil equivalent per day.

Its Pipeline business accounts for 58% of overall profits. The Facilities division, which gathers and processes natural gas, accounts for 27%, and its Marketing &New Ventures division makes up the rest.

At the end of 2019, Pembina acquired Kinder Morgan Canada, as well as the U.S. portion of the Cochin Pipeline system, for C$4.4 billion from Kinder Morgan (KMI). The move came a year after Kinder sold the Trans Mountain Pipeline to the Canadian government for a similar amount.

Pembina, which distributes dividends monthly, paid out C$1.3 billion in dividends in 2019. It raised its regular payout by 5% at the start of 2020.

Spain's principal natural gas carrier, Enagas (ENGGY, $11.95), delivers natural gas to eight European countries via a 10,000-kilometer pipeline network. And it's benefiting from the highest energy demand in that country in a decade.

Better still? 'No impacts have been evidenced by the situation of Covid-19 to be recorded in the first-quarter financial statements,' the company said in an April release. The company's Q1 profits jumped by nearly 15% year-over-year.

Enagas is diversifying its business outside the EU by acquiring a stake in Tallgrass Energy LP (TGE), a natural gas distributor that operates three interstate pipelines across the U.S. In addition, the company has a major stake in the Trans Adriatic Pipeline, which will carry natural gas supplies to Europe from the Caspian Sea.

The Dividend Aristocrat grew its final fiscal-year payout by 2.4% this year to reach 17 consecutive years of income expansion.